30% of Holiday Shoppers to Spend More if Their Chosen Presidential Candidate Wins, Research Reveals

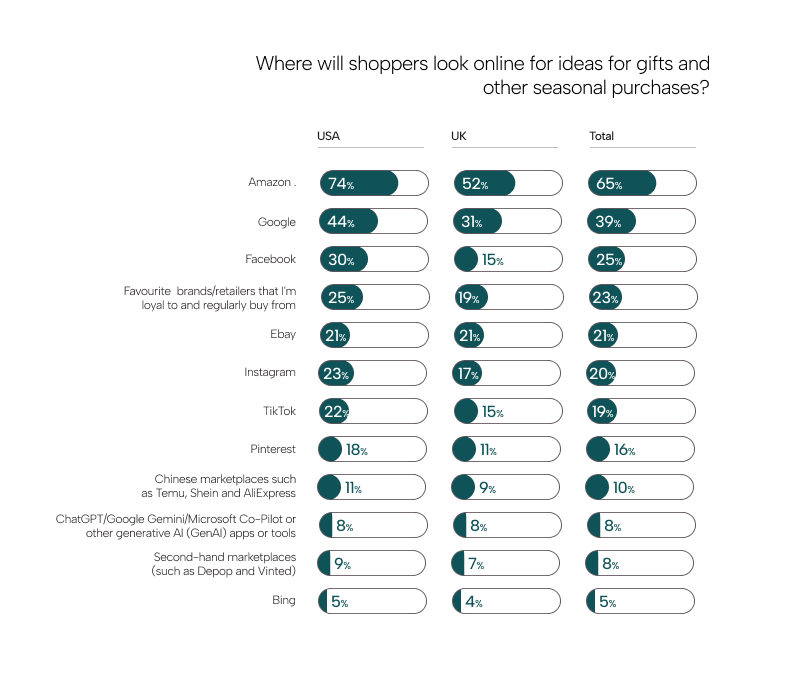

Amazon is the top source for seasonal gift ideas, but this year shoppers will also start asking for tips from the likes of ChatGPT and Google Gemini

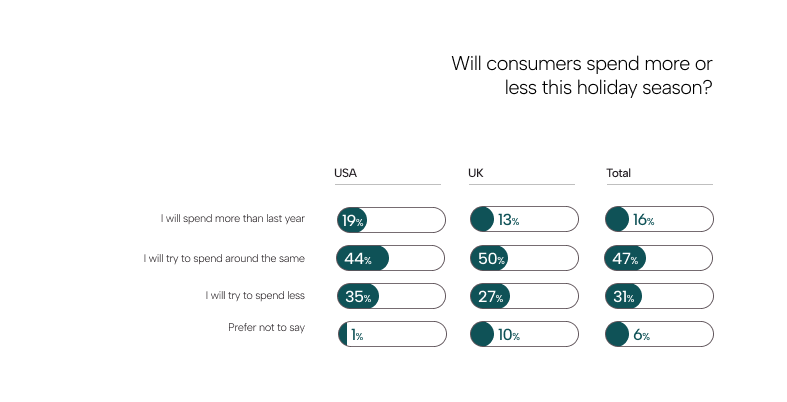

Nearly a third 1(30%) of US consumers will spend more this holiday shopping season if they get the confidence boost of seeing their chosen candidate voted in as President, according to new research. This potential sales uplift comes against a backdrop of consumer caution, as just 19% of people are planning to splash out more than last year, with 64% admitting their holiday budgets will be impacted by the rising cost of living.

2While Amazon (74%) is overwhelmingly the most popular destination for festive gifts and shopping ideas when US consumers look online for inspiration this year, 8% will also be asking for advice from Gen AI tools such as ChatGPT and Microsoft CoPilot. Google’s position appears under threat, with less than half (44%) now searching on it for seasonal shopping inspiration. 30% will look on Facebook, 23% on Instagram, 22% on TikTok and 21% on eBay. 25% will go directly to the ecommerce stores of their favorite brands/retailers2.

These are among the key findings of a new survey of 1,000 US consumers commissioned by commerce experience platform Nosto to uncover the key festive shopping trends in 2024. This is part of a wider survey of 2,000 US and UK consumers.

Across the US, a quarter 1(25%) of people say they are likely to purchase more second-hand gifts than last year – with 124% also making seasonal online purchases across borders. Around 12% say sustainability/environmental concerns will influence their shopping this year.

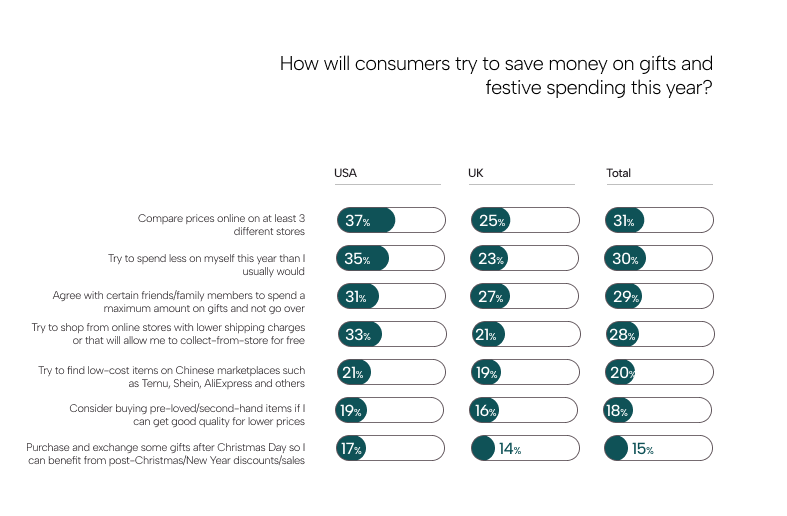

How shoppers plan to save money this year

Of the 88% of US consumers who plan to try and save money on their holiday shopping this year, 37% said they would compare prices online in at least three stores before making a purchase, while 21% will look for low-cost purchases on Temu, AliExpress and other Chinese marketplaces. 19% will buy pre-loved items if they can find good quality at low prices, while 17% admit that they will try to save by waiting to buy gifts in post-Christmas/New Year sales. 33% will aim to shop online at stores with lower shipping charges or those that allow collect-from-store for free.

35% will look to make savings by spending less on themselves than usual, while 31% will agree to set budgets with friends and family for gifts and not go over these. However, many consumers will still prioritize their furry friends, with 38% of all US consumers planning to buy gifts for their pets this year.

Paying for returns is a big bug-bear, with 50%1 of US shoppers revealing they will avoid purchasing gifts online from stores that don’t offer free returns or allow goods to be returned to a physical store for free.

What website features do festive shoppers find helpful?

When US consumers were asked which ecommerce website features are helpful when shopping for gifts or other festive purchases, the majority (81%) selected a ‘really good search function that shows relevant products. This was closely followed by product reviews and ratings at 79%3 .Seeing photos and videos of products from other customers who purchased them (user-generated content) was rated as helpful by 75% and image search (which lets shoppers search for products using images rather than text) by 72%.

“Overall, the research paints a picture of a cautious holiday shopping season with consumers continuing to feel the pinch from the rising cost of living,” said XX of Nosto. “As well as being price competitive, ecommerce merchants need to focus on optimizing the onsite shopping experience – consumers really value features such as good on-site search functionality, on-site reviews and ratings and the availability of visual user-generated content from other shoppers, for example. A lot of shoppers said they’d visit their favorite online retailers or brands for inspiration – so it’s important to identify and treat returning customers with special care.

“Merchants who can should also take advantage of the variety of trends the data has highlighted – like the growing willingness to buy second-hand gifts and the sizable number of people who will now wait to make gift purchases after Christmas – in the post-holiday sales season. And the fact that people are still willing to buy presents for their pets even if they’re watching their budgets.”

To access an overview of the survey findings, download the Nosto report ‘Peak season pulse: unwrapping shopper intentions for the 2024 holiday season’: https://www.nosto.com/blog/holiday-season-2024-consumer-trends-report/

-Ends-

About the research

Nosto commissioned international market research consultancy, Censuswide, to conduct the research. The survey was based on a nationally representative sample of 2,013 respondents across the US and the UK. The data was collected between 18.09.2024 and 23.09.2024. Censuswide abides by and employs members of the Market Research Society and follows the MRS code of conduct and ESOMAR principles. Censuswide is also a member of the British Polling Council.

About Nosto

Nosto is the intelligent Commerce Experience Platform (CXP) that gives brands intuitively designed tools to increase their online revenue through end-to-end commerce experience management. With experience.AI™, Nosto helps brands enrich and connect customer, product, and content data in real-time so they can action it across their site and deliver personalized and authentic online experiences. Nosto supports intelligent commerce experiences for more than 1,500 brands in over 100 countries, including Kylie Cosmetics, O’Neil, New Era, Raddison, Marc Jacobs, Virgin Australia, Belstaff, The Travel Corporation, Dermalogica, FIGS, Disney, SikSilk, and Todd Snyder.

Media Contact

Uday Radia, CloudNinePR

uradia@cloudninepr.com