New research: How international ecommerce brands can combat hesitations of cross-border shoppers

Technology has long paved the way for consumers to shop beyond their own domestic markets. Today, a growing pool of international ecommerce brands are enticing overseas shoppers with unique product offerings, competitive pricing, and more.

But while the global cross-border ecommerce market may be flourishing, new research reveals that many shoppers have concerns, hesitations, and a lack of trust when it comes to ordering from ecommerce brands based abroad.

For this research, we surveyed 2000 consumers across the UK and USA to investigate sentiment around buying from international online stores. We dug into their motivations, their concerns, how the on-site experience impacts their buying decisions, and, crucially, what merchants can do to foster their trust.

Who’s purchasing from overseas brands?

The majority of respondents surveyed (52.45%) reported that they had purchased from an ecommerce store based in another country within the last 12 months. A further 23.10% said they hadn’t, but had considered it, while the remaining 24.45% said they hadn’t considered it.

Demographic differences

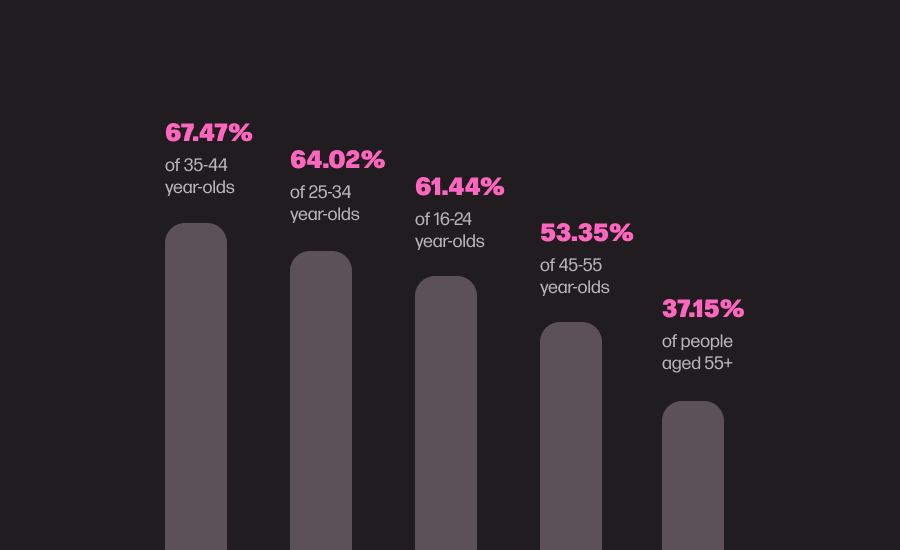

While cross-border shopping has become a habit across generations, generally, younger consumers are more likely to have made at least one cross-border purchase in the last 12 months:

What products are being purchased internationally?

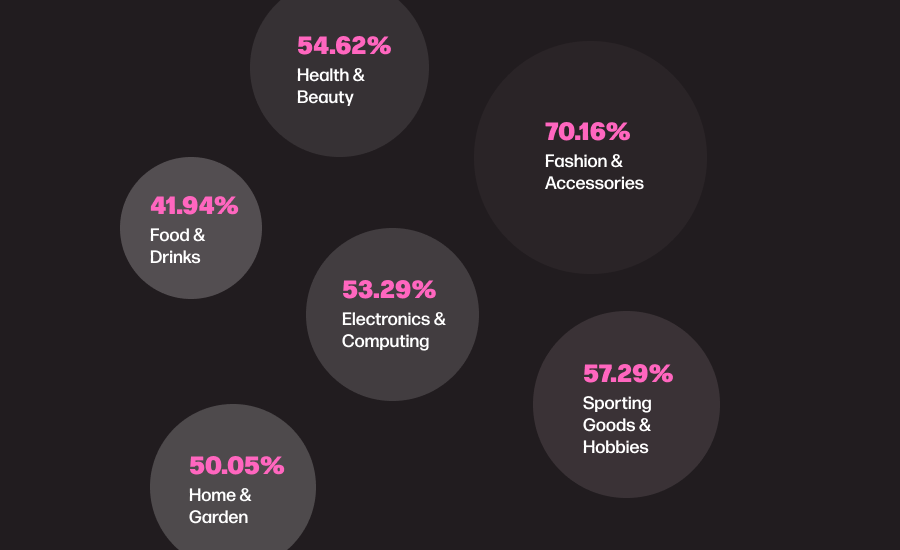

Among shoppers who have made at least one cross-border purchase in the last year, fashion & accessories is the category they’re most likely* to purchase from overseas stores:

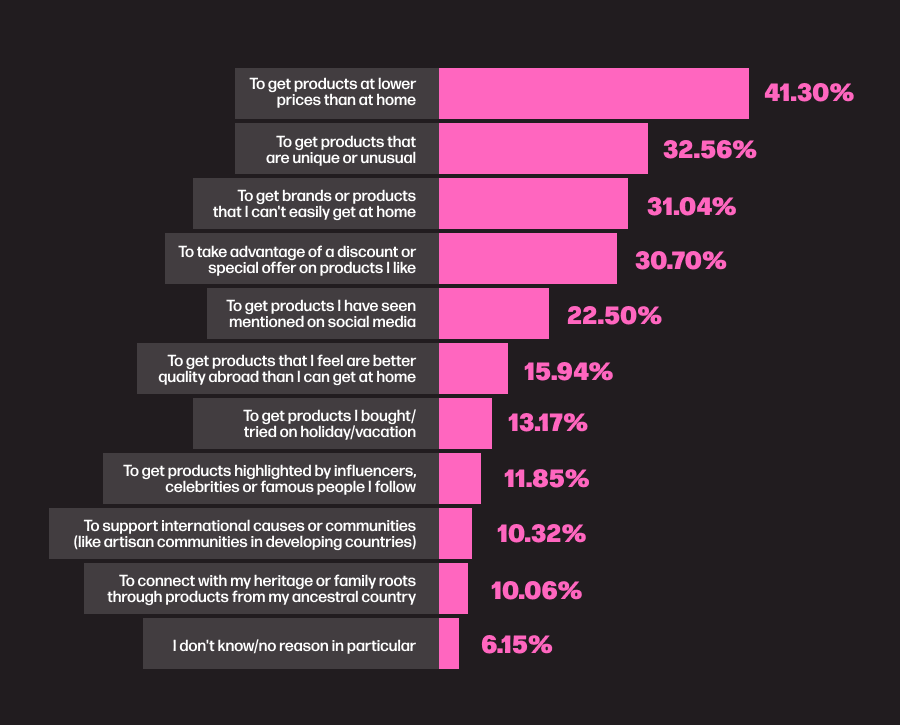

What are people’s motivations for shopping overseas?

As part of the research, we investigated the reasons why shoppers purchase or consider purchasing from ecommerce stores overseas:

Demographic differences:

- While price proved to be the biggest lure for consumers overall, for 16-24-year-olds (31.88%), the biggest motivator was to get items they see mentioned on social media (33.33%).

In a separate question, more than half (53.4%) of consumers agreed** that rising prices in their home country mean they’re more likely to look for products that might be more affordable overseas. And 29% said they don’t mind** buying fake/counterfeit products if they’re available and cheaper from an online store abroad (45.35% among 16-24 year-olds).

Despite this, however, consumers did say that if prices appear especially low, they become wary; 65.70% agreed** that if prices on an ecommerce store abroad are dramatically lower than those at home, it makes them suspicious about product quality.

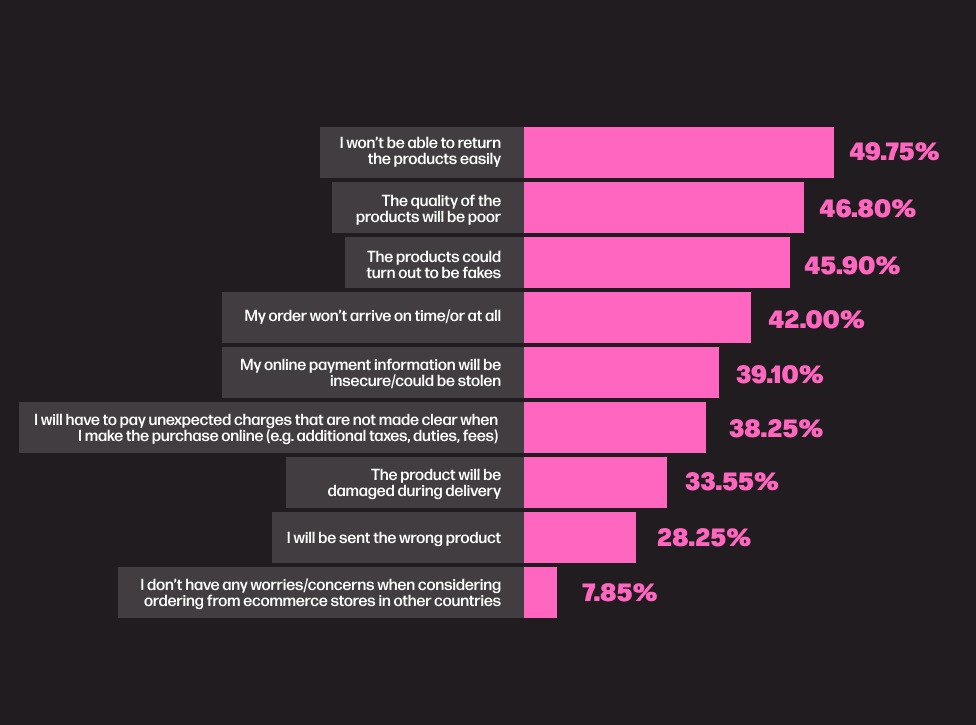

What concerns do shoppers have when considering ordering from ecommerce brands abroad?

We also looked into what general concerns shoppers might have when considering ordering from an ecommerce store outside their home country, and found that all but 7.85% of respondents had concerns:

Significantly, nearly half of the respondents expressed concern about not being able to return products easily.

Demographic differences:

- Many more UK shoppers (45.50%) expressed concern about needing to pay additional, unexpected charges compared to US shoppers (31.00%).

- Fewer men (44.13%) expressed concern about being able to return products than women did (54.97%)

- Generally, older consumers were more concerned than younger ones. For instance:

- 60.32% of those aged 55+ expressed concern about returning products (vs. 29.66% of 16-24 year olds)

- 54.33% of those aged 55+ expressed concern about products being fake (vs. 36.86% of 16-24 year olds)

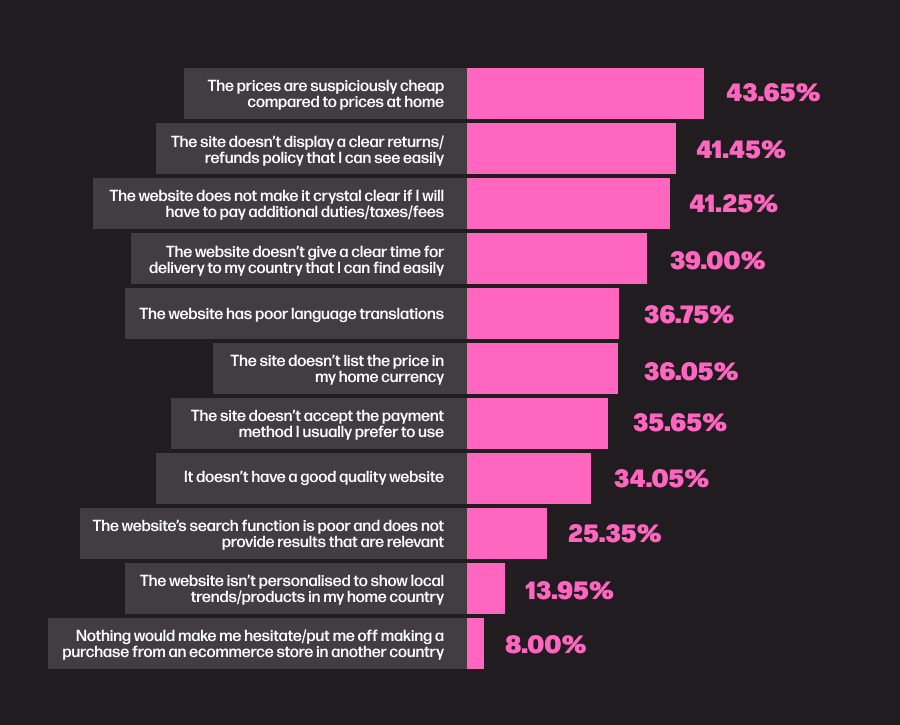

What deters shoppers from making a purchase when browsing overseas ecommerce stores?

Aside from investigating shoppers’ general concerns about the prospect of ordering internationally, we also looked into what specific things could deter them from making a purchase when browsing the store of an international ecommerce brand. Significantly, all but 8.00% of respondents reported factors that would put them off purchasing.

Demographic differences:

- Again, we found that older consumers were generally more likely to be affected by factors putting them off purchasing. For instance:

- 52.86% of those aged 55+ said they’d be put off purchasing if the prices were suspiciously cheap compared to prices at home (vs. 29.24% of 16-24 year olds)

- 49% of those aged 55+ said they’d be put off purchasing if the site doesn’t display a clear returns/refunds policy they can easily see (vs. 32.63% of 16-24 year olds).

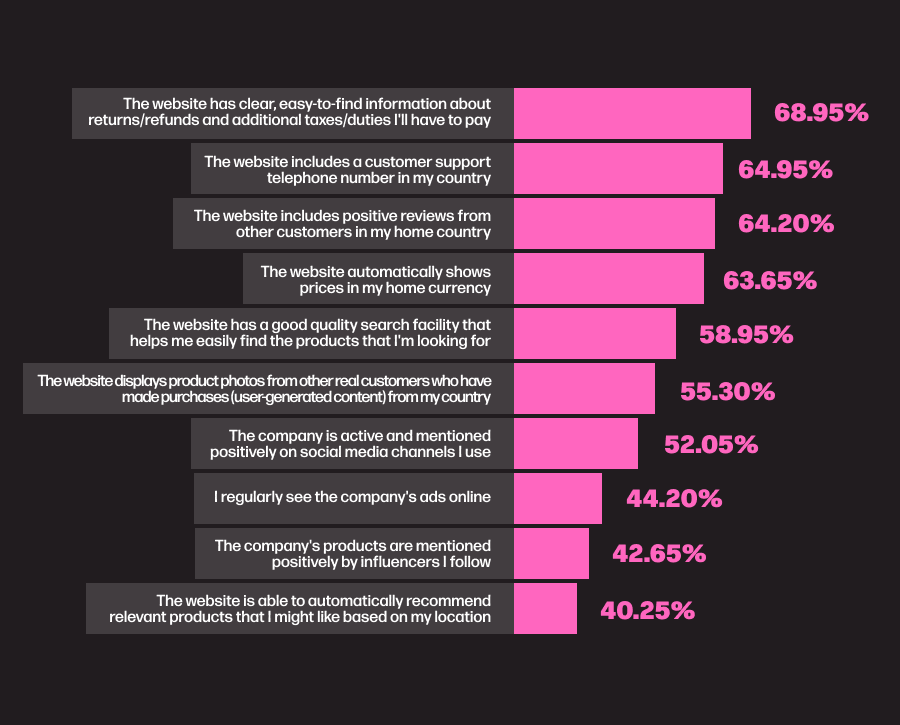

What do shoppers say would help build their trust in ecommerce stores based abroad?

We also wanted to identify how likely various factors could increase shopper trust in ecommerce brands based in other countries.

Over ⅖ of respondents said each of the above would likely aid their trust.

Respondents were almost unanimous in their belief that having clear, easy-to-find information about returns/refunds and additional taxes/duties would ease their trust—with over 60% of respondents from all age groups reporting this.

Demographic differences:

- Various factors appeared to be more fruitful for building trust with younger consumers as opposed to older ones:

- Over 50% of 16-34 year olds said recommending relevant products based on their location would help, vs 24.10% of those aged 55+

- Over 60% of consumers aged 16-44 said the company being active and mentioned positively on social media channels would help, vs. 33.95% of those 55+

- Over 57% of 16-44 year olds said companies’ products being mentioned positively by influencers would help, vs. 24.77% of those aged 55+

- Recommending relevant products based on a shopper’s location is especially important for shoppers based in the US (with 44% of them saying this would aid their trust, vs. 36.50% of UK consumers)

Trust plays a key role in cross-border ecommerce and the initial purchase experience is paramount. 76.35% of consumers agreed that if their first experience of purchasing from an ecommerce store in another country goes smoothly, they are likely* to consider buying from it again. However, 71.10% also agreed** they are less likely to give a second change to ecommerce stores in other countries if they have a poor purchasing experience (compared to ecommerce stores in their home country).

The impact of ESG factors on consumer attitudes to cross-border shopping

Environmental, social and governance (ESG) factors continue to play a role in consumer attitudes toward cross-border ecommerce.

67.3% of consumers agreed** they would not make a purchase from an ecommerce store in another country if they heard they were linked to factories with forced labor or poor working conditions. Meanwhile, 48.75% agreed** that they were concerned about ordering products online from far-flung destinations because of the environmental impact of transportation.

Key takeaways

International ecommerce brands must be mindful that consumers are more skeptical about making cross-border purchases—and also less forgiving.

This emphasizes the need for international merchants to carefully consider consumers’ concerns around cross-border purchasing and respond to these accordingly.

There were several trends that were prevalent within the research findings that merchants can, and should, act upon to help win and retain international customers.

Consumers need clear, transparent information about critical topics such as deliveries, returns, and additional fees

Firstly, the biggest concern shoppers had about ordering internationally was whether they could return products easily (with 49.75% stating this). Other significant concerns were whether their order would arrive on time, if at all (with 42% stating this), and whether they’d have to pay unexpected charges that weren’t made clear to them (with 38.25% stating this).

Similarly, consumers reported that if a website doesn’t clearly display a returns/refunds policy, doesn’t provide a clear delivery timeframe for their country, and doesn’t make any additional fees clear, they would be key purchasing deterrents (with 41.45%, 39.00%, and 41.25% of consumers voicing these, respectively).

All these issues center around the need for greater clarity for cross-border shoppers—be that around returns, delivery times, or additional ‘hidden’ fees. Given that price was cited as the biggest motivator for purchasing cross-border in the first place (with 41.30% stating this), transparency on the latter is especially important.

Before anything else, merchants should review what information their ecommerce store provides on these topics. Make sure it’s clearly displayed, uses transparent language, and is well-highlighted across the store (particularly at critical conversion points such as the PDP).

Social media and UGC play a notable role in urging shoppers to buy from overseas brands

When reviewing the reasons why shoppers consider purchasing from overseas ecommerce brands, almost a quarter of respondents (22.50%) said they’d done this to get products they’d seen on social media (with 33.33% of 16-24s year olds claiming this). Furthermore, over half (52.50%) the respondents said if a company is active and mentioned positively on social media, it will increase their confidence in purchasing.

In fact, the data illuminated a key trend around the influence of social proof—be that from influencers or organic brand advocates.

For example, 11.85% of respondents said they’d considered purchasing from an overseas brand specifically to get products they’d seen highlighted by influencers, celebrities, or famous people they follow (with over 18% of 16-34-year-olds claiming this). Additionally, nearly half of all consumers (42.65%) said the company’s products being mentioned positively by influencers they follow would increase their trust in purchasing.

The research also found that user-generated content, in particular, could be especially influential to shoppers browsing overseas ecommerce stores. For instance, 53.75% of respondents said it would harm their engagement if an ecommerce store didn’t feature user-generated content from shoppers in their country, making it challenging to appreciate how products are used and enjoyed within their community. Significantly, over 50% of consumers in every age bracket agreed with this.

Lastly, 55.30% said that if the site were to supplement product images with real photos from other customers who’d purchased, it would increase their trust in purchasing. This was particularly significant for those aged 25-34 (of which 67.99% agreed with this), and those aged 35-44 (of which 66.27% agreed).

In short, social media plays a clear role in generating brand and product exposure for overseas shoppers. But, crucially, shoppers need the social proof lent by the likes of influencers—and more significantly, real customers—to engage shoppers on store, and instill the confidence needed for them to purchase.

Onsite localization should go beyond price and language translations

A final trend that surfaced within the research was about consumer expectations of on-site localization.

It was unsurprising to see that a third of all respondents said that if a website doesn’t list prices in their home currency (36.05%) or has poor language translations (36.75%) this would likely deter them from making a purchase.

But the research also illuminated that merchants could be making further localization efforts to engage international shoppers and better nurture their trust.

For example, 71.40% of consumers said that if a site didn’t grasp their language or meaning behind their search queries, they’d be less likely to shop there. And this was a potent factor for all groups, with over 60% of consumers within every age bracket noting this.

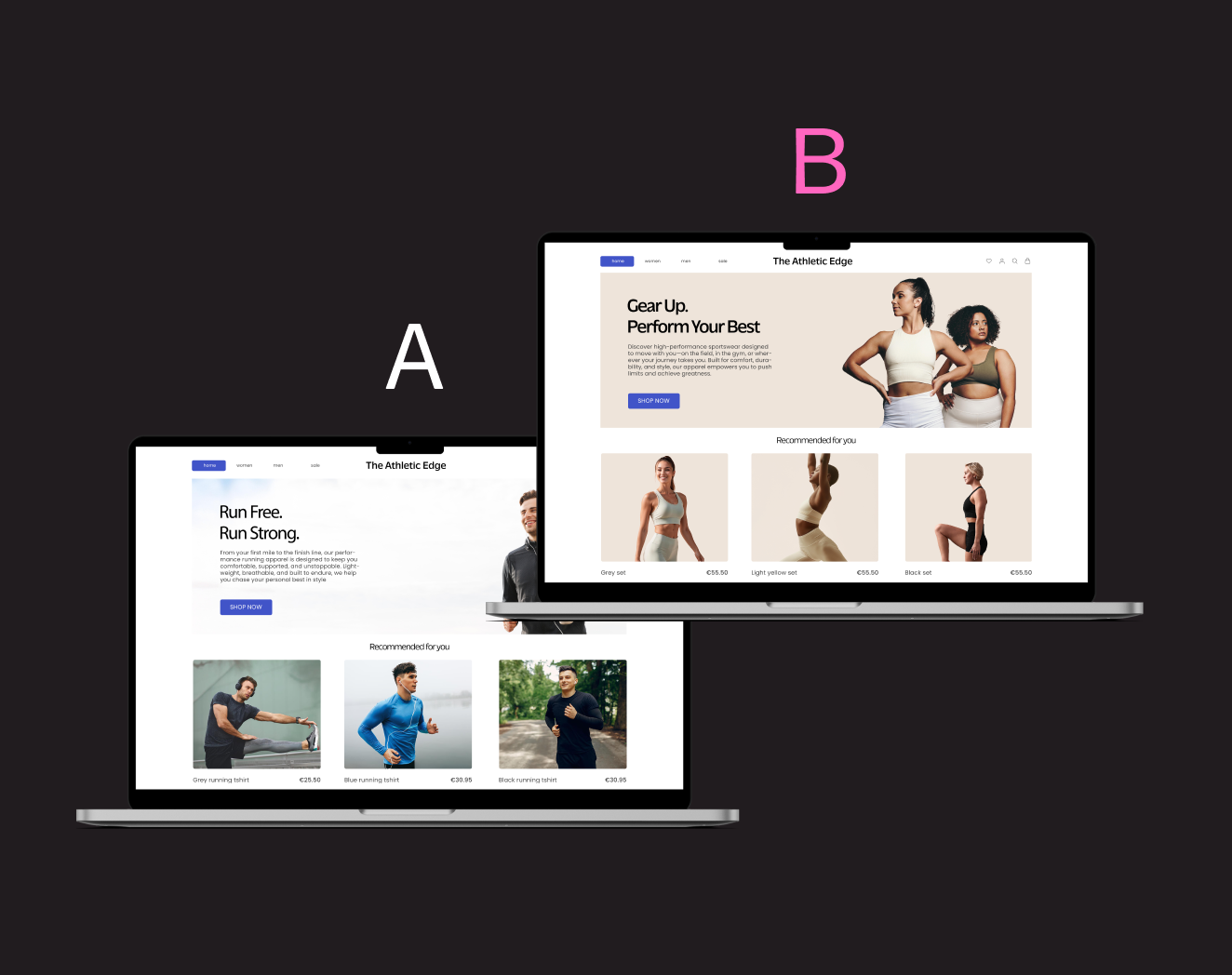

Further to this, 40.25% of the respondents said if a website were to automatically recommend relevant products based on their location, it would increase their trust. Crucially, 13.95% said if the website failed to do this, it would actually put them off making a purchase.

In summary, international ecommerce merchants should ensure their localization efforts don’t neglect key product discovery experiences such as product recommendations and the search function. It is important that the search experience, in particular, is localized for international shoppers—given that those who interact with a store’s search generally have much higher intent.

*’Somewhat likely’ and ‘Very likely’ answers combined

**’Agree’ and ‘Strongly agree’ answers combined

This research was conducted by Censuswide, among a nationally representative sample of 2000 respondents across the UK and the US. The data was collected between 15.04.2024 and 30.04.2024. Censuswide abides by and employs members of the Market Research Society and follows the MRS code of conduct and ESOMAR principles. Censuswide is also a member of the British Polling Council.