McDonald’s and Dynamic Yield: What it Means for Retailers

McDonald’s recently made headlines in the technology world when they announced their $300m acquisition of personalization platform Dynamic Yield.

This unusual pairing underscores a critical point in the evolution of omnichannel retail: 1-to-1 personalization is becoming a default layer of any shopping experiences involving a digital interface. And nowadays, digital experiences are found everywhere — even the fast-food drive-through.

For McDonald’s, embracing digital personalization across 14k+ U.S. locations offers some interesting potential improvements to the brand experiences of their 68 million daily customers.

In an interview with Wired Business, McDonald’s CEO, Steve Easterbrook indicated Dynamic Yield’s anticipated focus for the coming months and years, and that he ‘’expects to see the technology in 1,000 McDonald’s locations within the next three months’’. They plan to roll it out to the company’s 14,000 U.S. restaurants (and beyond) shortly thereafter.

While McDonald’s has stated they intend to continue to run Dynamic Yield as a standalone business, there’s an increased level of potential risk for current and prospective Dynamic Yield customers.

Why’s that? There is a long history of consumer retailers and brands acquiring AI, personalization, and marketing commerce technology companies and deciding to repurpose the technology internally. We’ve seen this happen with retailers such as:

- Walmart, who purchased Aspectiva (UGC technology platform) to offer behavior-based product suggestions to customers on-and offline

- Nordstrom, who purchased BevyUp and MessageYes (customer service messaging platforms) to connect store employees with clients, address questions and offer styling tips

- Ulta Beauty, who purchased QM Scientific and GlamST (AI-powered shopping assistance and augmented reality services, respectively) to use data from its loyalty program for personalization.

Additionally, the level of investment made by the likes of these technology companies may potentially yield long-term negative implications, specifically when they join forces with a corporate organization the size of McDonald’s.

It is not unlikely that as part of a larger organization, a growing but unprofitable technology subsidiary would have to significantly decrease their investment in product development, support and client management. With Dynamic Yield now reporting to McDonalds, their P&L could potentially be scrutinized differently.

As a retailer working with Dynamic Yield concerned with the success of my business, I’d start to wonder:

How well will my business needs be met? How much will I be able to influence the deployment of technology in my business? And what level of support and attention will I be getting from a technology company run by the largest fast food chain in the world?

The one crucial key to achieve omnichannel retail success

At Nosto, we’ve been on the front lines of massive changes in digital commerce — as both entrepreneurs and merchants — for many years.

Our conviction is that given the dynamic nature and complexities of the omnichannel shopping journey, retailers require (and should demand) focus from their technology vendors to ensure their needs continue to be met.

This means focus in terms of staying committed to the mission of building technology solutions for customers. Focus on solving unique challenges that are retail-specific. Focus on taking machine learning and actionability to the next level.

This conviction is the backbone of our approach to product development and customer service. We continue to invest in retail-specific capabilities, from our product graph to our visually enhancing dynamic product bundles and patented onboarding process for retailers.

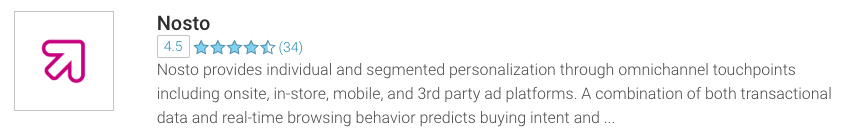

Likewise, our Customer Success team is dedicated to keeping us the highest rated ecommerce personalization solution in customer satisfaction:

And as we continue to innovate, we will continue to do so with focus on retailers first.